Option Seller ROI

Login

My Info

Send Login Link

Cancel

Save

Cancel

Log Out

To improve security this site is passwordless. A one time use login link wil be sent to your email. This link expires in 15 minutes. All data will be assocated with the email address you send a login link to.

Find the best ROI for selling options using optionsellerroi.com

Lets say you want to sell a cash secured put or a covered call on a stock. Where do you start? How do you pick the right expiration and the right strike? How do you calculate the return on your capital?

Optionsellerroi.com was built specifically to address these questions.

Terms to understand

Before we get started lets start with some option selling terms you'll want to know from this article.

- Out of the money (OTM): For a put option this means the stock price is currently above your strike. On a call option the stock price would be below your strike. When selling options we want our option to be OTM so we are not assigned.

- In the money (ITM): A put option is in the money if the stock price is below the strike and a call option is ITM if the stock price is above the strike.

- Extrinsic value: The part of the option's value that will go to $0 at the time of expiration.

- Intrinsic value: The part of the option's value that will remain at the time of expiration. OTM options have no intrinsic value. An ITM option has an intrinsic value that is the difference between the strike and the stock value.

- DTE: The number of days until the option expires. Options lose extrinsic value as they approach expiration.

- Delta: One of the "Greeks" that tells you the amount the option value will change relative to a $1 move in the underlying stock price. ATM options have a delta around .50 meaning a $1 move in the stock will move the option value $0.50.

Option Selling Ideas

If you are just looking for ideas you can start on the "Best ROI" pages for cash secured puts and covered calls. These pages show scans of high volatility stocks such as the ones found in the ARK innovation funds and SwaggyStocks.com. Growth stocks are volatile and therefore pay high premiums when selling options.

Finding the best ROI

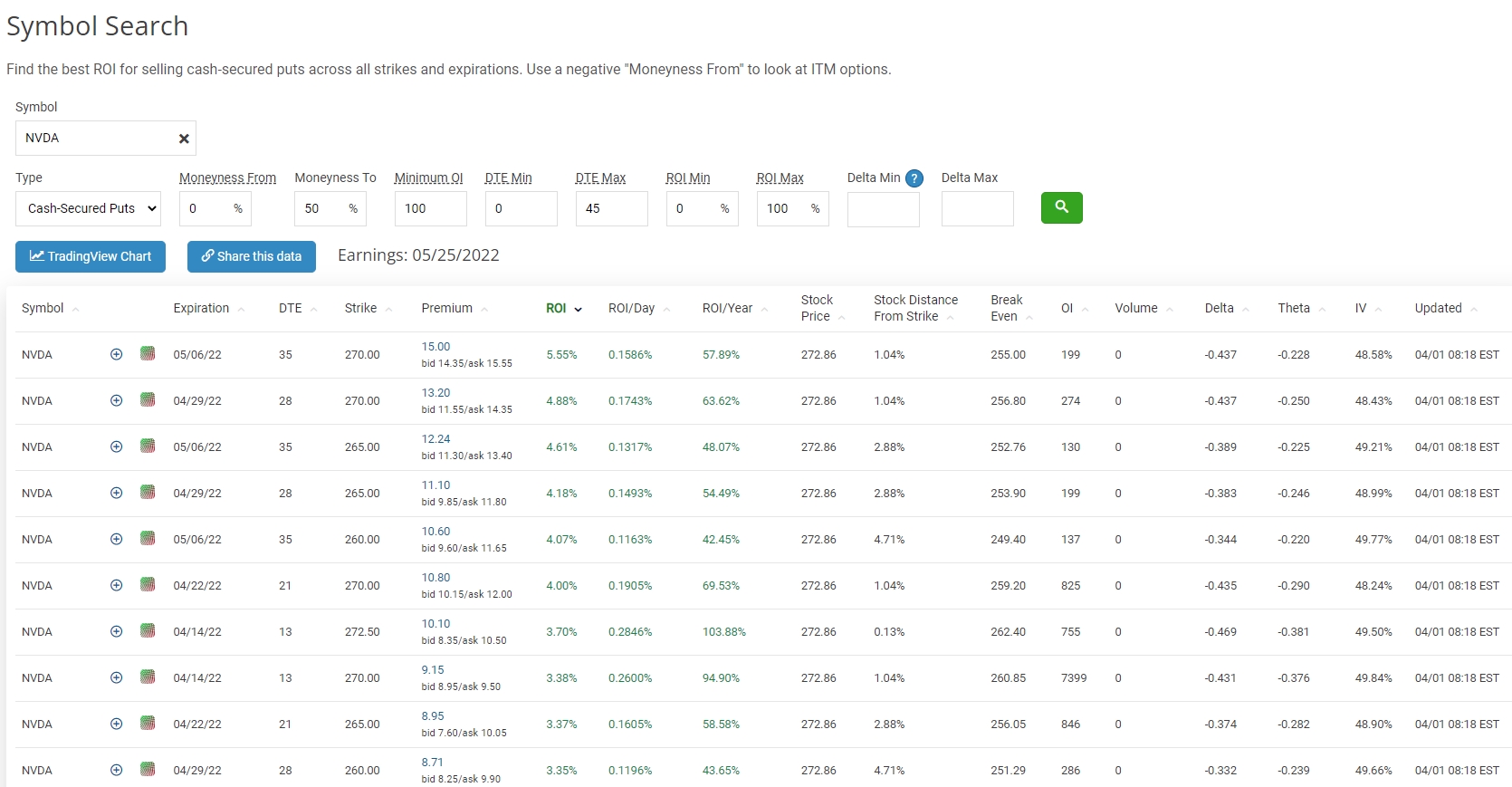

If you find a stock you want to sell options against you can jump over to the Symbol Search page. Let's look at an example of selling cash secured puts against NVDA. A solid company that is also volatile enough to pay a good premium for selling options.

Searching for NVDA on the Symbol Search page would give the following result.

Picking the right options

There's a lot of information here, so where do you start? I like to use the following guideline when selling a put.

- Am I willing to buy 100 shares of this stock? If so at what price?

- What is my target ROI for this investment?

- What is my plan if the stock price drops?

By default the data is sorted by the overall ROI for each option. Meaning if you are paid a premium of $15 at the $270 strike your ROI is 15/270 = 5.55%

That's good information but it doesn't give you a sense of ROI over time. The expiration date in this case is 35 days away, so my money is held up for 35 days waiting for this option to expire.

ROI / Year

Another way to look at this is using the ROI / Year column. This gives you a better idea of how much you could make yearly if you repeated this trade over the same time frame. If we sort by that column now we see our overall ROI might be less but our ROI / Year is significantly higher for the same strike but only 7 days away from expiration.

Search options

To help find options that we can sell to meet our goals several filters are available at the top of the data grid.

Type

Cash Secured Puts or Covered Calls.

Moneyness From / To

How far away the option strike is from the current stock price. The further OTM the option is the less premium is pays as it is less risky.

Minimum OI

The minimum amount of open interest on a given option. Open interest represents how many of these options are currently held open (either sold to open or bought to open). If the open interest is low it will be difficult to buy / sell this option quickly or for a good price as there aren't many people holding them.

DTE Min / Max

How many days until the option expires

ROI Min / Max

The range of overall ROI for a given option

Delta Min / Max

Delta is the measure of how much an option will go up or down relative to a $1 change in the underlying stock price. An ATM option will have a delta of about .50, meaning the option value will go up or down $0.50 for each $1 move of the stock price. Option sellers sometimes use the delta as a way to gauge the probability of an option finishing ITM and being assigned. So again a delta of .50 means there's a 50% change of being assigned. The further OTM an option is, the lower the delta.

Risk

Risk management is unique to each trader. Your goals and risk tolerance are what determine what options you should pick to sell against.

If you do not want to get assigned a good starting point is looking for options with a low delta. This indicates a low probability that the option will end up ITM and you will be assigned. This is not a guarantee and things can go bad quickly like any stock trade if you don't have a plan for exiting.

Another way to mitigate your risk is by selling a credit spread. This involves selling an option (short leg) at one strike and then buying an option (long leg) at a strike that is further OTM.

Credit Spreads

This is called a credit spread because you are paid a premium (credit) to open the trade. If the trade goes against you the long leg of the trade will help mitigate some of your losses (not all).

Lets look at an example using optionstrat.com which is a great resource to evaluate individual option trades.

In the first example we are selling a put against NVDA with just a short leg. You can see the maximum loss is if NVDA goes to $0. The second image shows the same trade but with an added long put below the short put. This long put will go up in value as NVDA's price drops. So if NVDA went to $0 the long leg would protect you from losing everything.

The upside to this is obviously the protection of your money. The downside is you lower the premium you collect on the short put because you have to pay out premium to buy the long put as protection.